Digital assets and existing financial IT.

The Problem: manual accounting processes.

More and more Corporations are using crypto for payments, DeFi, as a store of value or for NFTs. The challenge: integration into the existing financial systems and processes. Typical ERP, treasury or payment systems do not support access or integration to crypto and NFTs.

As a result, a lot of manual work is required to download CSV Files from Block Explorers like etherscan, collecting corresponding exchange rates from sites like coinmarketcap and then bringing it all together in a huge spreadsheet. Transforming the Blockchain Transactions into bookings on an accounting system involves even more manual steps including virtual account number generation for your own and the counterparties accounts for all tokens involved as well as reverse engineering stacked DeFi Smart Contract Executions.

Audit-Proof crypto tax accounting.

We have found that within blockchain ledgers, not all value changes are recorded as explicit transactions, particularly when using smart contracts for fungible tokens and NFTs, or on-chain multi-sig smart accounts like Safe. Therefore, our technology utilizes internal transactions and opcodes tracing to track these changes. Additionally, we meet regulatory requirements by recording receipts and accounting for value changes. As a result, we have developed a patent-pending technology that provides accounting with audit-proof statements showing opening and closing balances, as well as all transactions that result in changes in the value of their digital assets. Whether your Accounting software is SAP or SevDesk, DATEV or Stotax or any other software, with nupont all value-changing entries can be transferred securely and in accordance with the principles of proper accounting.

The Solution: automated accounting for crypto assets.

mt940 or camt.053 account statements for crypto transactions via ebics or sFTP

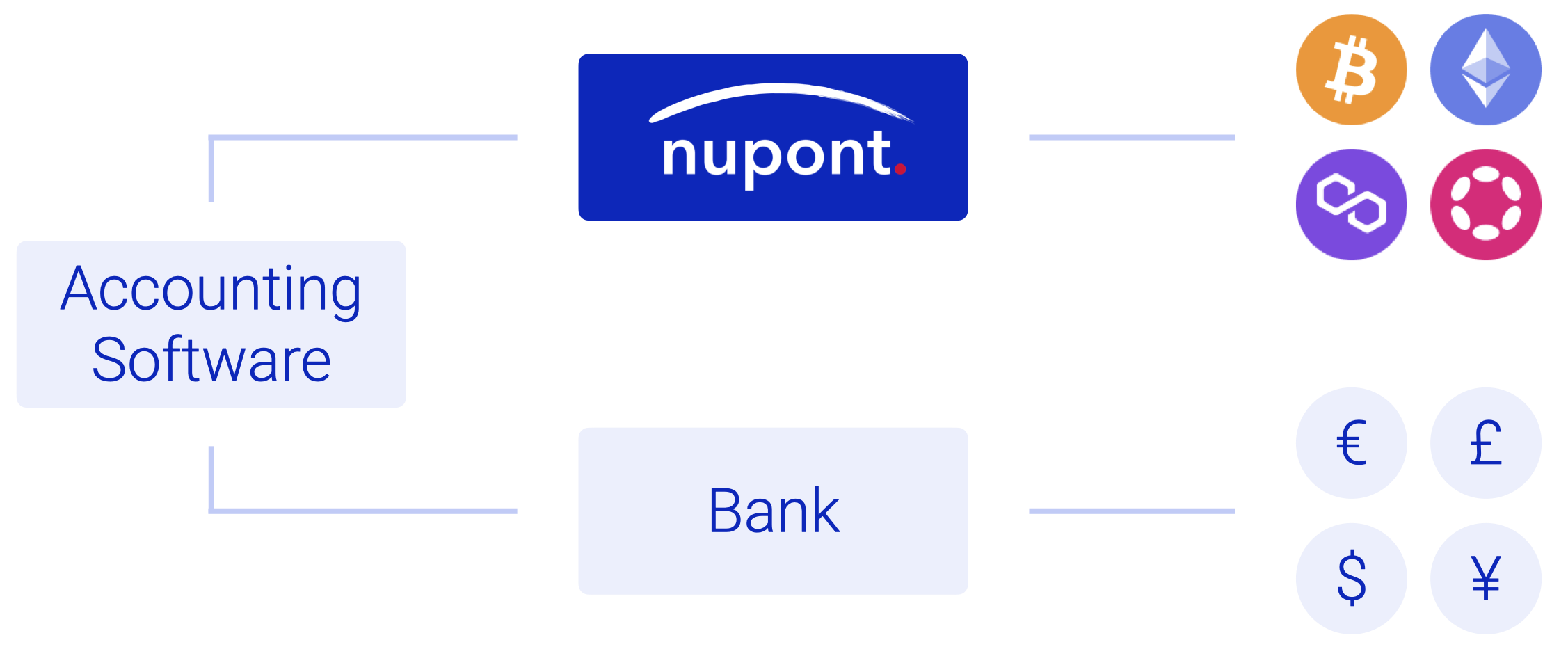

nupont builds the bridge between web3 based crypto assets and the Financial IT Systems based on standard ISO 20022 or SWIFT messages and protocols.

Access and integrate crypto as easily as a new bank or currency into your accounting, ERP or treasury management systems! Process audit-proof account statements for each crypto transaction - including internal transfers or receipts from smart contract executions, e.g. for DeFi or NFTs. Access via sFTP or EBICS communication channels and use the familiar standard formats such as MT940 or camt.053.

All without major IT involvement or lengthy pilot projects: A perfect solution for CFOs and Treasurers of businesses of any size!

Comprehensive Application to manage Corporate Crypto.

nupont offers businesses of any size the ability to access their crypto assets using the same protocols and file formats as their fiat banks. Clients register with nupont.app, validate their crypto account addresses, and can then use their existing software to communicate with nupont.app via EBICS or sFTP, for example. The magic happens behind the scenes and the crypto accounts become available in the customer's existing accounting, ERP or treasury management system.

Be it stablecoins, tokenized assets or tokenized deposits, any ERC-20 compatible digital asset will be processed into valid account statements and optionally converted into your preferred fiat currency.

Balances will be calculated based on amounts and gas-fees payed for each and every day and are provided alongside the transactions.

The nupont.app offers a comprehensive overview of all your assets on all networks and in all currencies. With intelligent filters you can specify what you want to see and swiftly find relevant transactions.

-

Dashboard with Overview of all Assets

Crypto visible converted in BTC, ETH, EUR, GBP or USD

Overview and Details of all Company NFTs

Setup of Corporate Accounts

Comprehensive Transactions and Statements Views

Checksums for matching with Accounting, ERP or TMS

Setup of Corporate User Schema

Individual Export Schedules for every Account

Generation and Management of Counterparties for easy postings to the accounting system

-

Account Statements can be generated in the following Formats:

camt.053

MT940

The currency can be set to:

EUR, GPB or USD

“XXX” with original Crypto Amount

An individually set 3 letter currency code for the original crypto currency

Custom CSV Files or any other Format can be generated upon request

-

The automated exports can be scheduled to be provided on either a nupont sFTP Server or a nupont EBICS Server to be compatible to most ERP and TMS Systems on the Market.

Other Protocols and an API can be utilized to directly access the nupont application upon request.